Product P&L

This post is the first in the Product Management Toolkit series covering different aspects of Product Management.

It covers some concepts around Product P&L. These concepts are majorly drawn from Corporate Cash Management business in an Indian context.

Background: One of the key responsibilities of a Product Manager in Banking is to manage the P&L of the Product(s) assigned to him/ her. It involves a strong understanding of the dynamics of revenue and costs associated with the business. This post provides a broad framework for this important area that is essential for a Product Manager to emerge successful. Here, the use case taken is of a Product Manager responsible for managing Corporate Cash Management Products. However, the concepts touched upon can be extrapolated for Retail Liabilities business as well and should also be useful for Cash Management/ Liabilities business in other geographies with some adjustments.

Importance of Product P&L: Some of the reasons that contribute to making the Product P&L important are:

- It provides a strong, quantifiable estimate of the efficiency of the Business

- It helps in taking Strategic decisions such as for new hiring (a low Cost – Income ratio shall justify this)

- It helps in identifying the cost elements that need to be re-looked in order to achieve greater efficiency.

The components: Broadly, the Product P&L has income and expenses associated with the concerned Product (Cash Management Services in this case) as components.

Income: The key constituents of Income in a Cash Management context are Net Interest Income (NII) and Fee Income. In some banks, the Cash Management business also encompasses Term Deposits placed by Corporate customers/ Financial Institutions, while in others, it is restricted to Current Accounts belonging to Corporate customers/ Financial Institutions. In the former case, the NII from Term Deposits also gets added to the revenue.

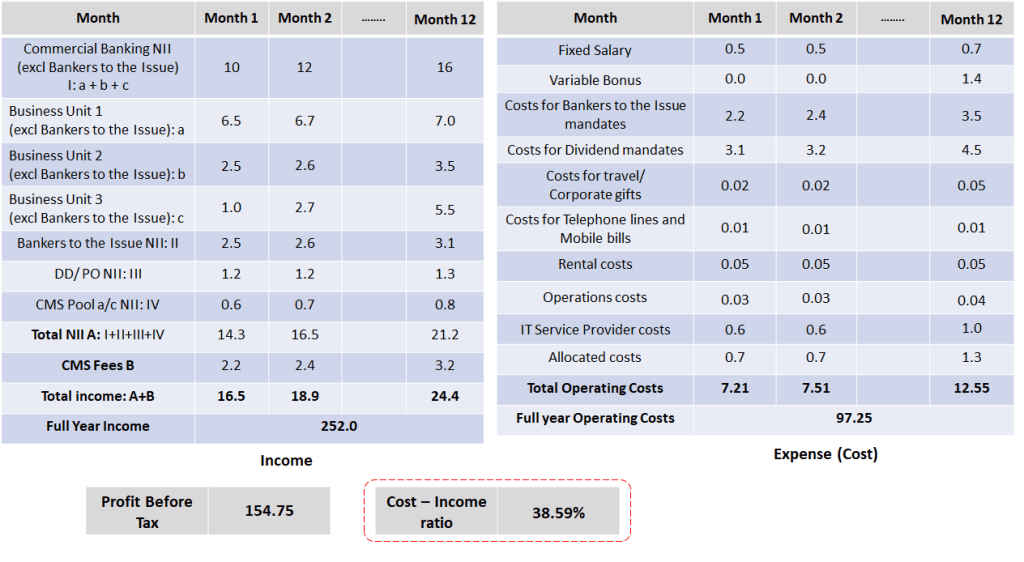

In the attached image, the Income table has 3 Business Units; these represent three different Business verticals under Commercial Banking (e.g. SME, Mid – Market and Large Corporate). The income from Bankers to the Issue mandates (IPOs, Rights Issues, FPOs, Bond Collections, etc.) has been defined separately since in many banks that’s a significant component of the Cash Management income. Also, some banks have an income split between Commercial and Consumer Banking Segments for such mandates and only the Commercial Banking portion of the income flows into the Cash Management P&L.

There are two additional NII components: i) DD/ PO NII and ii) CMS Pool a/c NII. The DD/ PO NII refers to the float income from issuance of Demand Drafts and Pay Orders/ Bankers Cheques on account of the time lag between date of encashment of these instruments and their issuance. CMS Pool a/c NII refers to the float income on account of ‘Day arrangement’/ ‘Cheque purchase’ arrangements, where the bank receives the funds prior to providing credit to the Client. In case Term Deposits fall under the ambit of Cash Management, the corresponding NII (FTP income – Interest cost) shall get added.

CMS Fees refers to the overall fee income generated under Cash Management across Collections, Liquidity Management, Escrow and Payments Products. The total NII and CMS Fees together constitute the total income

Expense (Cost): The major components of expense/ cost are (i) Direct Costs such as Salary and Bonus of Staff (including costs of Support functions such as Operations and IT); (ii) Costs for handling Bankers to the Issue and Dividend mandates and (iii) Other costs such as those related to travel/ corporate gifts, costs for telephone lines and mobile bills, rental costs, Operations costs (this shall include branch costs for various Cash Management mandates, correspondent bank costs for Cheque Collection/ DD drawing, vendor costs for Cheque Collection/ PDC management/ Payment Gateway Solutions, etc., printing and stationery costs for Cheque/ DD/ PO printing, courier costs for collection of Outstation Cheques, etc.), IT Service Provider Costs (for Cash Management Software as well as for ongoing system developments and annual maintenance).

In addition to these costs, in case of MNC banks, there would also be allocated costs on account of Staff at Regional/ Global Offices of the bank, who are associated with the Cash Management business.

Variation in cost elements for Retail Liabilities business: In case of Retail Liabilities business, certain additional cost elements such as Debit Card cost, Call Centre Cost, DICGC Premium (DICGC: Deposit Insurance and Credit Guarantee Corporation, a subsidiary of India’s Central Bank, RBI), Incentive cost (applicable for staff who are on incentive structure rather than bonus), account set – up cost, Advertising and Marketing cost, etc. shall also get added. On the other hand, costs associated with services that belong to Corporate Cash Management (Bankers to the Issue, Dividend Payments, Collections and Payments Solutions using correspondent banks and vendors, etc.) shall not be applicable.

Cost – Income ratio: Once the respective components of Costs and Income associated with the Business are arrived at, the Cost – Income ratio can be defined. In the example chosen, it comes out as 38.59% (97.25/ 252.0) for the full year. The efficiency of this Business can be judged by how this ratio stacks up against the Cost – Income ratio for the concerned bank as well as against equivalent business of banks of similar size.

Other important parameters: Besides the Cost – Income ratio, it is also critical to look at the following:

- Profit Before Tax: It is the difference between the Income and the Operating Costs. In this example, it is 154.75 for the full year

- Period ended Liabilities and Average Liabilities: The End of Period Liability balances of Commercial Banking and the Average Liabilities are also important – the Liability balances impact the overall Cash Management Income significantly

- Key Performance Indicators (KPIs): (i) Revenue as % of Average Liabilities, (ii) Cost as a % of Average Liabilities and (iii) Profit Before Tax as a % of Average Liabilities. These are self – explanatory.

Some challenges faced by Cash Product Managers: Some challenges faced in constructing an accurate Product P&L are as follows:

- Obtaining the Salary & Bonus costs for all Units associated with the Business

- Arriving at accurate costs for some components such as travel, rental costs, etc.

- Finding out accurate estimate of branch costs – this requires Activity Based Costing (ABC), which is not available in several banks

- Estimating allocated costs in case of Regional/ Global structure – this needs Finance inputs

- DD/ PO NII which is difficult to separate between Commercial and Consumer Banking Units (as only the Commercial Banking portion shall form part of Cash Product P&L); banks generally have an estimated split for this

- CMS Pool a/c NII which is dependent on Operations/ Service Provider providing accurate details.

Would like to know the challenges faced by you in constructing a Product P&L and how these could be addressed better.

Hope this post was useful…do keep reading this space for more on Product Management!