While this post has been written keeping the Product Manager working for a Bank/ Financial Services organisation in mind, the concept can be extrapolated to other sectors as well.

Background:

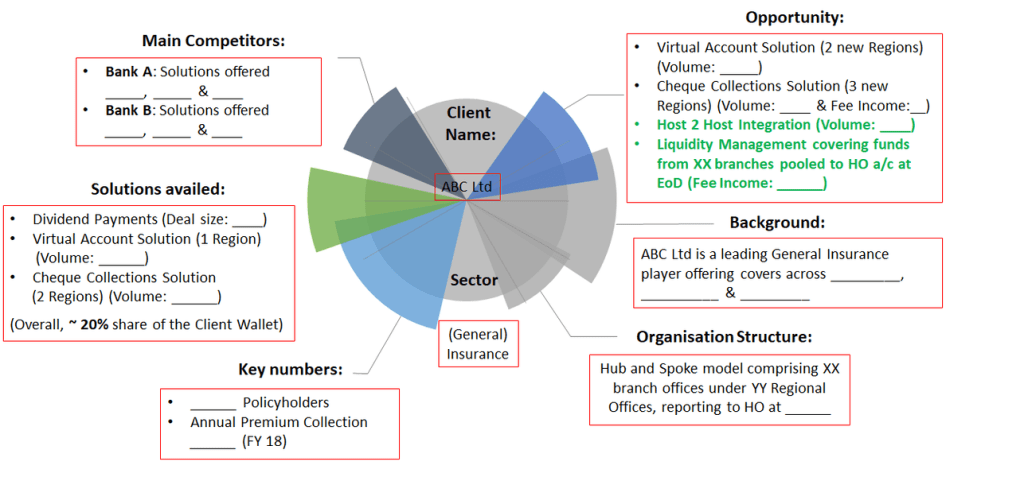

One of the responsibilities of a Product Manager is to regularly carry out ‘Opportunity Mapping’ of business for the Products/ Services he/ she is handling. This is important from a Strategic perspective, keeping in mind the oft – quoted Pareto Principle which implies that 80% of Business shall come from 20% of customers. So, the organisation needs to invest time, resources and budgets (if required) on cementing its business from its top customers and continuing to grow its share of their wallet.

Ingredients:

1. List of key clients: Drawing up this list is the starting point. For a Corporate Cash Management business, the criteria could be revenue/ profit (most important), throughput/ volumes, range of products offered, Client importance from a ‘marketability’ perspective (e.g. a Large Corporate Client/ Govt entity could be more cherished on account of the brand that organisation carries which could help garner business elsewhere), etc.

2. Obtaining Business Information: This shall include key stats of the organisation, such as Annual Turnover, Organisation Structure, number of branches/ offices, present volumes of Solutions offered & revenue (leading to derivation of share of wallet), etc. This information can be obtained through a combination of company’s Website/ Annual Reports, client level numbers available through IT/ Operations teams, interaction with Relationship teams managing the client as well as one’s network (as feasible).

3. Main Competitors: Information about competition enables the Organisation to identify which client offers more scope for deepening of the relationship (for instance, one could compete on technological superiority, ease of customization, geographical reach, defined SLAs and lastly the pricing, depending on competitors).

4. Present Solutions/ Relationships: For an organisation offering multiple Solutions (such as a Bank offering various Collections, Payments & Liquidity Management Solutions), one needs to include the Solutions presently being offered to the client. For a company providing a single Standard Solution (such as a Fintech co offering Payment Gateway Solution to Corporates), this could capture the Zones/ Departments that are availing the Solution.

5. Opportunity identification: In either of the examples stated above, the objective is to identify Business Opportunities that could be explored. For that, the Product Manager needs to understand the ‘Product fitment’ basis the business model/ line of business. For instance, a Payment Gateway Solution could be offered to a Utilities Company/ a company into Online auctions, etc., a PDC management solution could be ideal for a Non-Banking Finance Company, while a Virtual Account Solution could be more apt for Co – operative Banks (India) receiving payments on behalf of their customers, Companies where branches/ dealers are making electronic payments to Regional or Head Office/ distributors, respectively (i.e. wherever ‘remitter identification’ can be ‘Productised’). Accordingly, the Opportunity Mapping can be outlined.

A typical Opportunity Mapping Document for a Corporate Cash Management relationship is illustrated in the attached slide. The details may be customised basis the nature of business/ Products being handled by the Product Manager.

Hope this post was useful…do keep reading this space for more!