This post seeks to provide some ideas on Liquidity Management, a key aspect from the perspective of a Corporate Treasurer. This is a one of the important areas for a Product Manager handling Cash Management Services.

Background: Liquidity Management focusses on ensuring that a Company is able to meet its current and future obligations when they come due, in as timely, efficient and cost – effective manner as possible. In other words, Liquidity is access to cash. This article looks at the concept of Cash Concentration, which is one of the means of ensuring effective Liquidity Management. Besides Cash Concentration, many Corporates/ Financial Institutions also avail other Liquidity Management features such as Netting, Notional Pooling, Interest Optimisation, etc. However, these other features are not permitted by regulatory guidelines in several major countries (such as India).

Some typical use cases of Cash Concentration: The article looks at the following use cases of Cash Concentration availed by leading Corporates/ Financial Institutions in India:

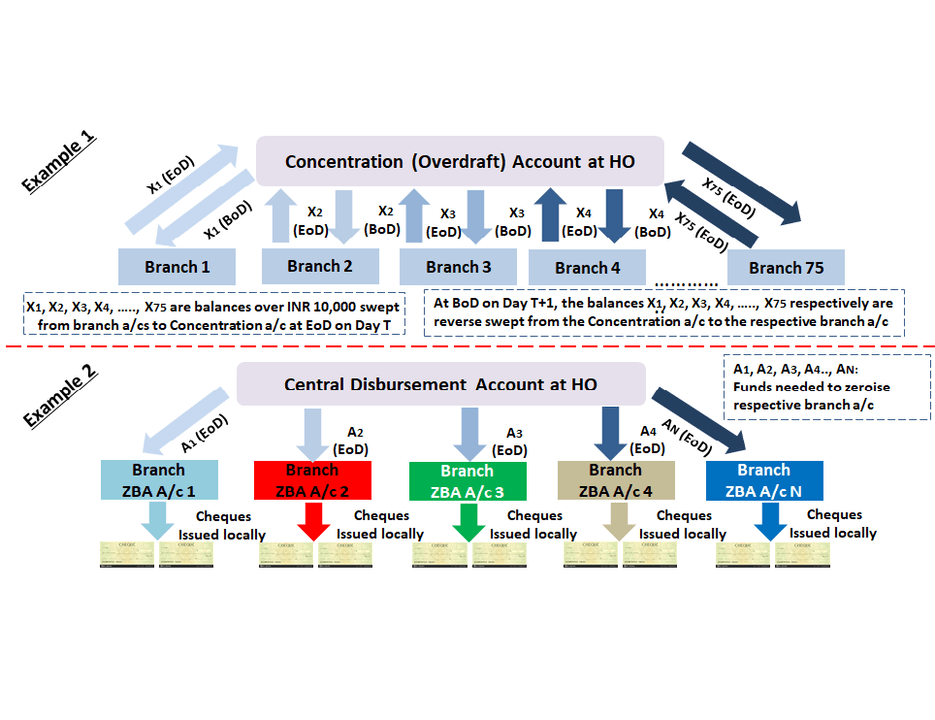

- Target Balancing and EoD sweep (day T) to Concentration Account followed by BoD reverse sweep (day T+1)

- Zero Balance Account (ZBA) Structure with child accounts making local payments, going into intra-day debit balances and being zeroised at EoD through sweep from the Central Disbursement Account.

Details of the use cases:

Target Balancing and EoD sweep (day T) to Concentration Account followed by BoD reverse sweep (day T+1):

Profile of the Client: Leading foreign exchange player

Client need: The Client was availing Working Capital facilities from the concerned bank. Their Business Model was a ‘Hub and Spoke’ one where they had 75+ branches across the country receiving collections daily and needing to make payments daily as well. They had a Cash Credit/ Overdraft account at HO. The need was to transfer surplus balances from the branch (‘child’) account to the HO (‘parent’) account in order to reduce the Overdraft interest cost. However, the exact amount transferred daily (day T) had to be transferred back (‘reverse swept’) into the respective branch (‘child’) account the next day morning (BoD on day T+1) in order to enable payments to be made locally.

Challenges at Client end: In the absence of an automated Solution, Client teams were remitting (‘sweeping’) funds (through Online Banking) from branch accounts to HO account daily and again from the HO account back (‘reverse sweep’) the next day. This was leading to a lot of operational effort at their end and engagement of manpower.

Solution offered: The Liquidity Management Solution offered enabled: (i) EoD sweep over INR 10,000 (target balance) from the branch accounts to HO account automatically on day T and (ii) BoD reverse sweep of respective amounts transferred to the HO account from the concerned branch accounts back to the latter on day T+1 (following day) in an automated manner. This covered all the 75+ branch accounts of the Client.

Benefits to the Client: a) Reduction in interest cost on the Overdraft account at HO; b) Streamlining of funding and payment requirements of Client’s branch and HO accounts; c) Utilization of manpower for more productive tasks.

Benefits to the bank: a) Strengthening of the relationship at Commercial Banking level; b) Opportunity to offer additional Services in the future to the Client with demonstration of the Solutioning Capability.

Limitations: Admittedly, a Solution of this nature has limited revenue potential from the narrow prism of Cash Management. The only revenue is the NII on balances in the child accounts and any funds transfer fees Client is agreeable to pay. However, when viewed from a broader perspective, this kind of complex deal structuring can open doors for other Solutions such as Collections/ Payments/ Dividend mandates as well as for other Products under Transaction Banking/ Commercial Banking from the same client. While the concentration of funds centrally into the Overdraft account was a smart decision by the Client Treasury team to reduce interest cost, the bank had to offer this Liquidity Management Solution in order to address the Client requirement as well as ward off any other Banking player from taking over the relationship, in a highly competitive landscape.

Zero Balance Account (ZBA) Structure with child accounts making local payments, going into intra-day debit balances and being zeroised at EoD through sweep from the Central Disbursement Account.

Profile of the Client: Leading General Insurance Company

Client need: This Client also had a ‘Hub and Spoke’ model where local branches were making cheque payments daily. The Client did not want to leave idle balances in these branch accounts and wanted to allow only as much funds with these branch accounts as could enable the daily payments.

Challenges at Client end: The Collections from branches across the country were getting pooled into their Central Collections account as part of the concerned bank’s Cash Management offering. It was not feasible to make an exact estimate of funds required for cheque payments at each branch level – this situation would have led to either a surplus or a deficit position at branch account level.

Solution offered: A Zero Balance Account Structure was offered where branch (‘child’) accounts were at zero balance and allowed to go into intra – day debit balances (through a limit defined) while making cheque payments locally. At EoD, the respective intra – day debit balances at the branch accounts were zeroised by moving (‘sweeping’) funds from the Central Disbursement Account maintained at the HO with the same bank. Given the fact that Client branches were available across the country, this Solution was quite significant in terms of coverage. Customised MIS Reports were made available to the Client teams as per their requirements.

Benefits to the Client: a) Optimal liquidity management ensuring surplus balances are not left at branch accounts; b) Operational efficiency brought about by the automated solution; c) Smooth reconciliation through customised MIS Reports.

Benefits to the bank: a) This Liquidity Management Solution helped in further strengthening the relationship with the Client – there was already a relationship for Collections and Payments (and later for Dividend Payments as well); b) The Solution became a showcase/ marquee deal while presenting Cash Management Capabilities to Clients as well as Relationship teams; c) At a Client relationship level, there was significant Fee as well as Float income from the Client already; the Solution enabled the bank to move ahead of many other banks in terms of size of business.

Another Liquidity Management Solution: In this case, Client (leading tyre manufacturing company) wanted to pool cheque collections from their dealers (through Cash Management Collections Solution) directly into their Cash – Credit/ Overdraft account to reduce their interest cost. The bank negotiated with the Client to offer a Liquidity Management Solution that ensured that 30% of their Collections were routed to their Current Account with the bank and the remaining (70%) into their Cash – Credit/ Overdraft Account. This was enabled through a development in Core Banking that split the collected funds into two at EoD: 30% going to the Current Account and 70% to the Overdraft account. The Client had to make all payments from the Current Account.

In this manner, the bank was able to enjoy float income on Current Account balances, besides continuing to enjoy the Fee income from the Collections Solution (and income from the Working Capital facilities provided on the Commercial Banking side). It is worth mentioning that making Clients agree to this model (to move some portion of Collections to a Current Account and not to the Overdraft Account) is not easy and depends on multiple factors, including strength of the relationship, pricing for various services offered, etc.

Solution Development: All the Liquidity Management Structures covered in this article were developed In-House using the Bank’s Core Banking System. However, there are some Service Providers offering Liquidity Management Solutions as well. A decision on which model to opt for has to be taken at each bank’s level.

Would welcome your views/ thoughts on this topic. What are the emerging trends in Liquidity Management? How can banks optimally balance profitability as well as Client convenience through such mandates?

Do keep reading this space for more on Product Management….